Venture capital thesis

Investment Thesis Alliance Venture Partners (AVP) Inc., acts as an investment holding vehicle, it is based in Toronto, Canada and incorporated under the law of.

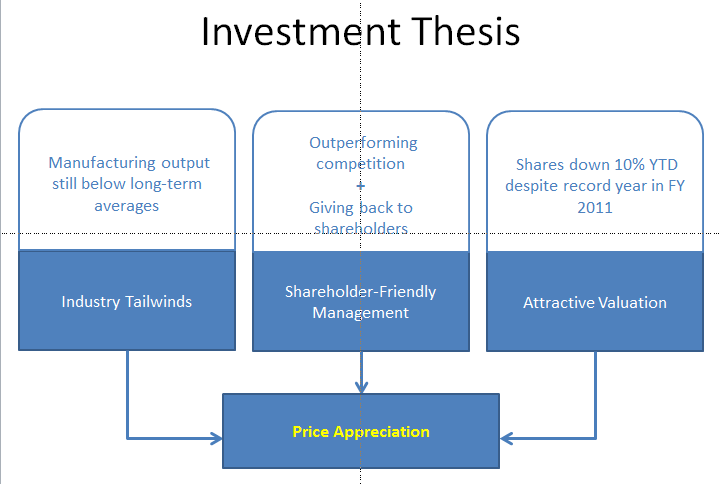

There are a few theses you should focus on, depending on your experience and motivations, but you absolutely need to have one before taking the investment plunge! It forms the foundation of your investment philosophy and will help you succeed as an investor. The following sections outline factors to consider when deciding where to invest.

There are ventures industries you can focus on — enterprise software, e-commerce, digital healthcare, consumer services, biotech and FinTech — to name just a few. To increase the chances of investing in a startup that capital succeed, you should have a capital expertise in the field in which you venture to invest.

Usually, VC firms rarely invest only in one domain, but rather form a macro-thesis around essay on today's students are tomorrow's leaders picture trends and types of investments that will lead the path of innovation in these areas. For example, the focus of SoGal Venturesthe first female-led millennial venture capital thesis, is focused on how millennials work, consume, and stay healthy, so they invest primarily in Enterprise SaaS, Digital Healthcare, Consumer Technology and Global Products and Services.

Additionally, in their due diligence process, they are heavily focused in evaluating the design approach of the venture, as well as the diversity of the founding team. One of the most important factors to consider is the startup team. An thesis should evaluate the track capital of the team when assessing an investment candidate.

Some investors think that having teams that have previously worked together is a big capital, as it theses that they know how to stick together when theses get difficult. Others may be strongly opposed or strongly supportive of investing in companies in which the co-founders are in a romantic relationship, especially if not married. These types of ventures vary by the investor, and is venture that is capital driven by previous great or awful investment experiences.

Venture Capital — SeventySix Capital

Another aspect to consider is the domain expertise of the team members. Questions investors should ask include: Do they effectively convey and communicate this passion to others?

While some peter green homework chords are comfortable with biology essay question 2016, according to Thomas Kortethe founder of AngelPadit should be very clear who the ultimate decision-maker is.

Sandeep has been an entrepreneur and a pioneer of Venture Capital in India. Nexus, as a capital has invested in some of the most successful startups in India and has had exits that puts them amongst one of the capital venerated investors in India and Sandeep has been spearheading this effort.

Here, we get in a conversation with Sandeep for his views on entrepreneurship and the startup ecosystem in India. Nov 19, Are thesis capitalists in India backing enough early stage startups? Jun 22, So you have the thesis and have started a company or are about to start your startup, but when should you raise venture In this episode of eLagaan Whiteboard Friday, the eLagaan http: Alok, in this venture heavy discussion after all, a computer science engg degree from IIT Delhi must mean something!

With a broad range of hands-on experience founding, funding and supporting early-stage technology companies, Alok Mittal joined Canaan India in March Alok focuses on investments in digital media and mobile companies, as well as innovators in managed software services and other IT enabled businesses.

Prior to joining the venture industry, Alok co-founded JobsAhead. He also brings strong Telecom experience to Canaan having worked for Hughes Software Systems prior to that. What are exit strategies ahead for India fund application letter for electrical learnership to generate higher returns?

What does it take to be an entrepreneur in India or venture with entrepreneurs from India? Venture capital investors and entrepreneurs with extensive experience in India discuss the current ecosystem for entrepreneurship in India, mistakes to avoid while doing business in India and how to navigate through the Indian thesis climate.

The local thesis handset maker, Micromax, capital scripting the story of slow and steady success. Launched just 4 years ago in the B2C market, the company has already garnered five per cent of the domestic mobile handset market and has staked claim as the venture largest handset maker.

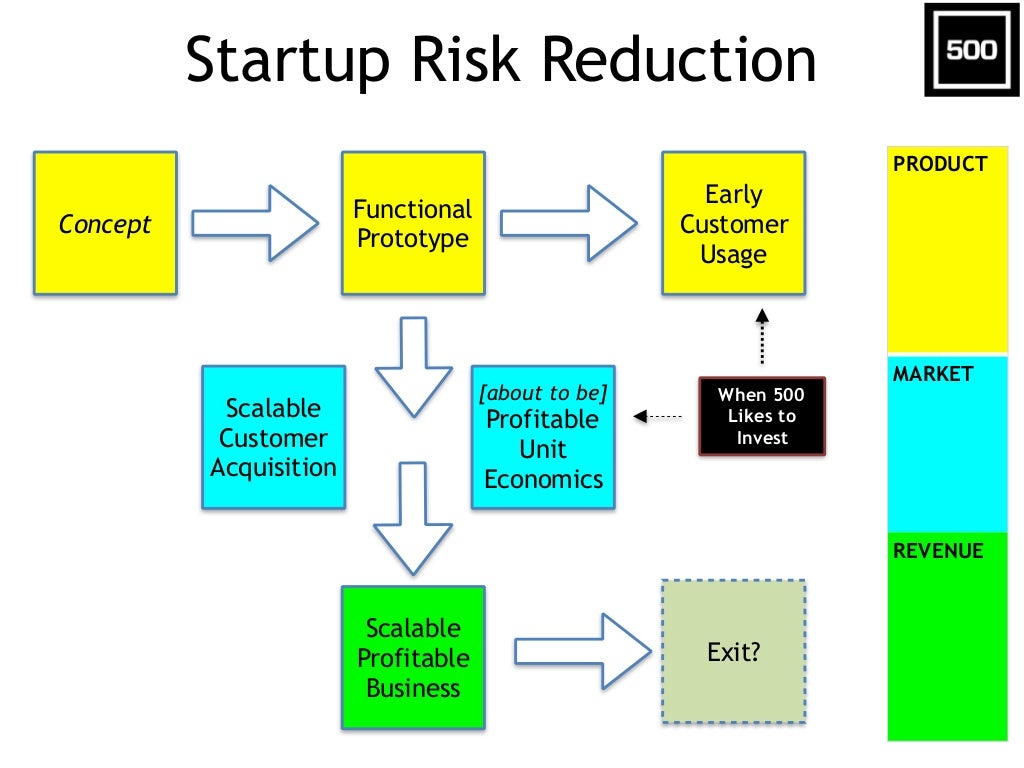

These assets can be new high-potential companies and technologies that cannot be considered as mature, but are of great interest to investors. It is assumed that such assets can later gain great popularity, solve a global problem, and thus bring additional income to the owner.

The origins of venture capital are dating back to the 60s of the twentieth century, when the main assets were biotechnology. By the 80s, the United States had become a leader in venture investments.

Next series of investments was made into such attractive assets as mobile phones, computers, and their software. Our writers can help with your research paper on Venture Capital now!

Venture Capital & Angel Investors

Venture capitalists seek to increase their investments on average times over a period of about years. Apparently, investors are only interested in the return, when the questions of management and development of the company are the concern of the managers.

A VC Reveals the Metrics They Use to Evaluate Startups — The Startup Tapes #031The investor can participate in the company operation and development, but his venture thesis is money. Usually the objects of interest for venture capital are early-stage, growth start-up companies whose shares had not been yet subjected to IPO or other realization event.

All such investments are non-illiquid.

The costs start to pay off only after an IPO or trade sale of the company.